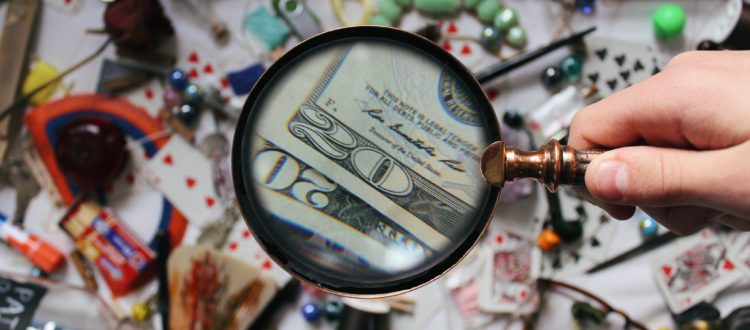

Due Diligence: Quality Inspection for Business Sales

When you buy a home, you get a home inspection. When you buy a car, you take it to the mechanic. Before shipping a board or assembly, it goes through several levels of inspection. Buying a business is like a one-time AOI test for a complex, multi-million-dollar assembly. However, there is no time for rework; once you buy the business, it’s too late for a failure in the field, or the rework may be very costly.

Typically, the main due diligence starts once a letter of intent (LOI) is signed, and the general terms of the deal are agreed upon. A buyer usually asks for an exclusive period, such as 60–90 days, during which the buyer will perform due diligence, and both parties will negotiate the purchase agreement and other agreements.

During due diligence, the buyer will request that the seller submit a wide variety of documents related to all aspects of the business. In particular, the sectors involved are financial, legal, asset, environmental, and employment matters. Buyers also want to talk with customers, suppliers, key employees, and others.

Many first-time sellers get overwhelmed by the amount of data required, the time needed to respond, and the depth of the requests. The seller knows the business well and has lived with the inherent risks of the business for years, so sellers often wonder why buyers need to review so much information. Sellers must understand that buyers have a responsibility to their stakeholders, investors, lenders, and other parties to perform a thorough investigation of the business.

That being said, due diligence should be a confirmation of the information that the seller has supplied prior to the letter of intent, not a chance for the buyer to figure out if they really want to buy the business or to find ways to renegotiate the price and terms. If the buyer finds an issue during due diligence that is significant, they will naturally want to change the deal. However, the buyer should be prepared to acquire the business under the terms of the LOI if nothing major comes up.

For most businesses with one location, the initial due diligence request list is usually 5–15 pages long. For larger companies, or if the buyer wants to do a complete corporate colonoscopy, the initial list can be 20–50 pages long. Many of the questions may be somewhat redundant. For example, many lists have 10 different ways to ask whether a business has certain kinds of debt, environmental issues, or legal issues. If a business has a union, for example, there may be 10 supplemental questions about the pension fund, contracts, etc. Often, many of the questions can be answered by “none” or “not applicable.”

One of the keys for sellers is to be prepared before going into due diligence. Upon request, we would be glad to send a sample/simple due diligence list. By being prepared, not only can the owner speed up due diligence, but also resolve any issues in advance. For example, many owners have outdated shareholder agreements, or they may have old liens on their assets. Even if an owner is not planning to sell, it is good to keep all documents in order. If the owner is planning to sell within three years or so, we recommend that they put together a basic amount of information into a virtual data room.

If issues come up during due diligence, and they often do, it is good for the parties to discuss the issues as soon as possible. Some problems can be resolved quickly, while others may require major changes to the deal. If the buyer is going to make major changes, or possibly back out of the deal, it is important for both sides to know that before spending any more time or money on the deal. By this time, both parties have invested a lot in the deal; most of the time, we are able to resolve any issues and close the deal.

Although the due diligence process can be exhausting, it is important that owners keep their eyes on the prize of closing, stay positive, and continue to run their business. There are many highs and lows; as entrepreneurs, owners are used to being on a rollercoaster, but for first-time sellers, it can be an emotional process. Be sure to keep running the business as usual, keep buying TP and pencils as if you are not going to sell, and start looking at round-the-world tours. But don’t buy the tickets until the money’s in the bank!

Tom Kastner is the president of GP Ventures, an investment banking firm focused on sell-side and buy-side transactions in the tech and electronics industries. GP Ventures has offices in Chicago and Tokyo, with five people in total. Tom Kastner is a registered representative of and securities transactions are conducted through StillPoint Capital, LLC—a Tampa, Florida, member of FINRA and SIPC. StillPoint Capital is not affiliated with GP Ventures.